Monthly mortgage loan payments

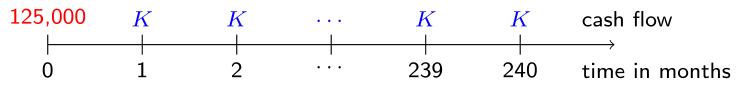

Cynthia's parents receive a loan of 125,000 EUR in return for fixed monthly payments \(K\) over the next 20 years as visualized in the graph below.

Using the variables number_payments and monthly_interest defined in the previous exercise, which are preloaded for you, it's up to you to determine the value of \(K\) based on the principle of actuarial equivalence.

Diese Übung ist Teil des Kurses

Life Insurance Products Valuation in R

Anleitung zur Übung

- Define the discount factors corresponding to the first payment month up until the last payment month. Do this by raising 1 plus

monthly_interestto the power minus a vector from 1 untilnumber_payments. - Create the variable

paymentswhich reflects the payment pattern. This should be a vector of ones with lengthnumber_payments. - Finally, calculate the monthly payment \(K\) by dividing the mortgage amount 125,000 by the present value of the payment pattern.

Interaktive Übung

Vervollständige den Beispielcode, um diese Übung erfolgreich abzuschließen.

# Define the discount factors

discount_factors <- (___) ^ - (___)

# Define the payment pattern

payments <- rep(___, ___)

# Calculate the monthly loan payment K

K <- ___ / ___(___ * ___)

K