Saving for university

Cynthia's parents anticipate her graduation from high school and start saving money to finance her studies. For each study year at a Belgian university, they will need 3500 EUR.

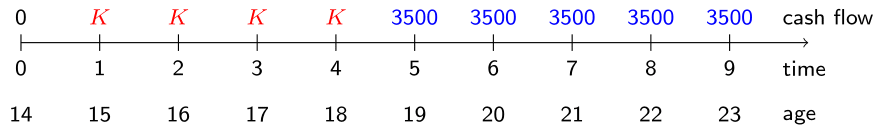

In the timeline printed below, the red cash flows denote the saving deposits by Cynthia's parents and the blue cash flows denote the study expenses.

Assume a constant interest rate of 3%. Can you compute the value of the savings amount \(K\) using the notion of actuarial equivalence of cash flows?

Deze oefening maakt deel uit van de cursus

Life Insurance Products Valuation in R

Oefeninstructies

- Define the

discount_factorsat times 0 through 9 for the assumed interest rate of 3%. - Create the vector

deposits, representing the deposit pattern corresponding to all 10 time points. Since deposits are only made at time points 1 to 4, the vectordepositsshould start with a 0, then four times a 1 and then 5 times 0 again. - Define

payments, representing the expenses at the university. This vector should contain 0 five times, followed by 3500 (five times, again).

Praktische interactieve oefening

Probeer deze oefening eens door deze voorbeeldcode in te vullen.

# Define the discount factors

discount_factors <- (___ + ___) ^ - (___)

# Define the deposit pattern

deposits <- c(___, ___(___, ___), ___(___, ___))

# Define the university expenses

payments <- c(___(___, ___), ___(___, ___))