The interest rates they are a-changin'

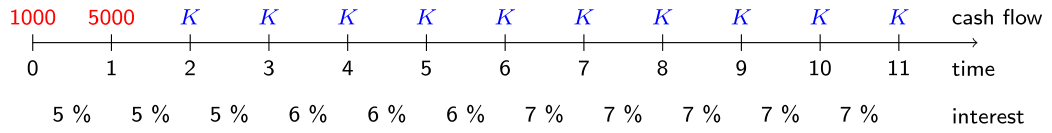

Cynthia wants to borrow money from her parents to finance a trip to Australia. She needs 1000 EUR this year and another 5000 EUR next year. She wants to repay the money with yearly payments \(K\) as shown on the timeline below.

The interest rate in the loan agreement is not constant, but changes over time as illustrated on the timeline.

These yearly interest rates are predefined in the vector interest. Can you verify that under these conditions Cynthia's yearly loan payments \(K\) should amount 816.86 EUR?

Questo esercizio fa parte del corso

Life Insurance Products Valuation in R

Istruzioni dell'esercizio

- Compute the yearly discount factors as 1 plus

interestto the power minus 1. - Define the discount factors from each future time point to the present moment.

- Specify the full cash flow vector with positive values 1000 and 5000 representing the loan amounts and 10 negative values

-816.86representing the loan payments. - Calculate the present value of the cash flow vector. This amount should be (up to rounding) equal to zero indicating an actuarial equivalence.

Esercizio pratico interattivo

Prova a risolvere questo esercizio completando il codice di esempio.

# Interest rates

interest <- c(rep(0.05, 3), rep(0.06, 3), rep(0.07, 5))

# Define the yearly discount factors

yearly_discount_factors <- (___) ^ ( - 1)

# Define the discount factors

discount_factors <- c(1 , ___(___))

# Define the cash flow vector

cash_flow <- c(___, ___, rep(___, ___))

# Calculate the PV

PV <- ___(___ * ___)

PV