Lo mejor de ambos mundos: el seguro dotal

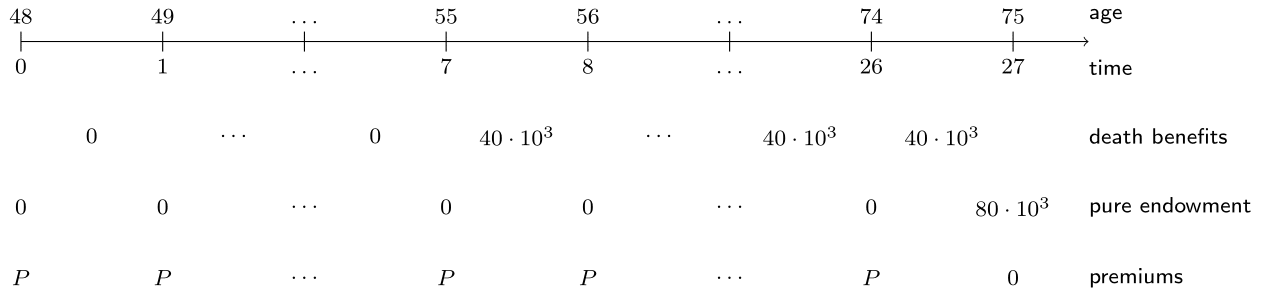

Cynthia conoce bien a la familia de la señorita Cathleen y su situación financiera. Le sugiere pensar en los gastos de una residencia y añadir un componente de ahorro a su póliza que pague 80.000 EUR si sigue viva a los 75 años. La señorita Cathleen quiere financiar este seguro dotal usando primas constantes \(P\). La configuración completa del plan de seguro de vida se muestra en la siguiente línea temporal.

Las probabilidades de supervivencia px, el tipo de interés i y EPV_death_benefits, que calculaste en el ejercicio anterior, están disponibles en tu espacio de trabajo. Ahora te toca a ti determinar el nivel de prima \(P\).

Este ejercicio forma parte del curso

Valoración de productos de seguros de vida en R

Instrucciones del ejercicio

- Determina el EPV del seguro dotal puro multiplicando la prestación de 80.000, el factor de descuento \((1 + i) ^ {-27}\) y la probabilidad de supervivencia \(_{27}p_{48}\).

- Calcula el EPV del patrón de primas y asigna el resultado a

EPV_rho. - Imprime el nivel de prima \(P\) usando el concepto de equivalencia actuarial.

Ejercicio interactivo práctico

Prueba este ejercicio y completa el código de muestra.

# Pure endowment

EPV_pure_endowment <- ___ * (1 + i) ^ - 27 * prod(px[(___):(___)])

EPV_pure_endowment

# Premium pattern

kpx <- c(___, cumprod(px[(___):(___)]))

discount_factors <- (___) ^ - (0:(length(kpx) - 1))

rho <- rep(1, length(kpx))

EPV_rho <- ___

EPV_rho

# Premium level

(___ + ___) / ___