Depósitos del plan de ahorro

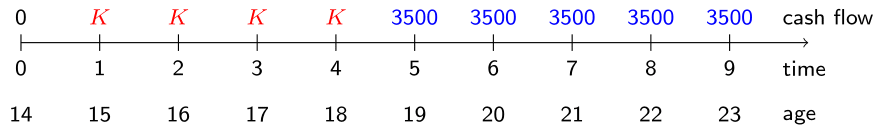

Ahora que ya has definido las variables discount_factors, deposits y payments, estás listo para determinar el valor \(K\) de los depósitos anuales de ahorro usando la relación de equivalencia actuarial entre los depósitos (flujo de caja en rojo) y los pagos (flujo de caja en azul).

Este ejercicio forma parte del curso

Valoración de productos de seguros de vida en R

Instrucciones del ejercicio

- Calcula el valor presente del patrón de depósitos como el

sum()del producto elemento a elemento dedepositsydiscount_factors. - Haz lo mismo para el patrón de pagos, sumando el producto de

paymentsydiscount_factors. - Usando el concepto de equivalencia actuarial, el depósito anual

Ken los cuatro primeros años se puede calcular dividiendoPV_paymententrePV_deposit.

Ejercicio interactivo práctico

Prueba este ejercicio y completa el código de muestra.

# Calculate the present value of the deposits

PV_deposit <- ___(___ * ___)

# Calculate the present value of the payments

PV_payment <- ___(___ * ___)

# Calculate the yearly deposit K in the first 4 years

K <- ___

K