Valor actual neto de inversiones

Joe, el dueño del restaurante favorito de Cynthia, te pide consejo. Quiere comprar un nuevo horno para pizzas, que cuesta 10.000 EUR. Espera que esta inversión genere flujos de caja adicionales, pero se pregunta si el nuevo horno será rentable.

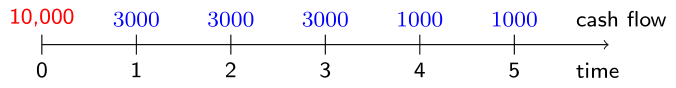

Deberías calcular el valor actual neto (VAN) de la inversión de Joe. Este VAN es la suma de los valores actuales de los futuros flujos de caja (en azul) generados por la inversión, menos su coste inicial de 10.000 (en rojo) en el momento 0.

¿Cuál es tu recomendación para Joe? Supón que los tipos de interés son constantes e iguales al 5%.

Este ejercicio forma parte del curso

Valoración de productos de seguros de vida en R

Instrucciones del ejercicio

- Crea

cash_flowscon los flujos de caja positivos asociados a la inversión. El vector empieza con un cero. - Define

discount_factorscomo 1 más el tipo de interés del 5% elevado a menos un vector de 0 a 5. - Calcula el

net_present_valuede la inversión como el valor actual de los beneficios futuros menos el coste inicial de 10.000. ¿Joe obtendrá un beneficio o una pérdida total?

Ejercicio interactivo práctico

Prueba este ejercicio y completa el código de muestra.

# Define the cash flows

cash_flows <- c(0, ___(___, ___), ___(___, ___))

# Define the discount factors

discount_factors <- (1 + ___) ^ - (___)

# Calculate the net present value

net_present_value <- ___(___ * ___) - ___

net_present_value