Deposits of the saving plan

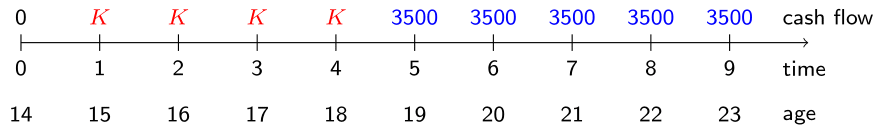

Now that you have defined the variables discount_factors, deposits and payments, you are ready to determine the value \(K\) of the yearly savings deposits using the actuarial equivalence relationship between the deposits (red cash flow) and the payments (blue cash flow).

Bu egzersiz

Life Insurance Products Valuation in R

kursunun bir parçasıdırEgzersiz talimatları

- Calculate the present value of the deposit pattern as the

sum()of the elementwise product ofdepositsanddiscount_factors. - Do the same for the payment pattern by summing over the product of

paymentsanddiscount_factors. - Using the concept of actuarial equivalence, the yearly deposit

Kin the first four years can be calculated by dividingPV_paymentbyPV_deposit.

Uygulamalı interaktif egzersiz

Bu örnek kodu tamamlayarak bu egzersizi bitirin.

# Calculate the present value of the deposits

PV_deposit <- ___(___ * ___)

# Calculate the present value of the payments

PV_payment <- ___(___ * ___)

# Calculate the yearly deposit K in the first 4 years

K <- ___

K