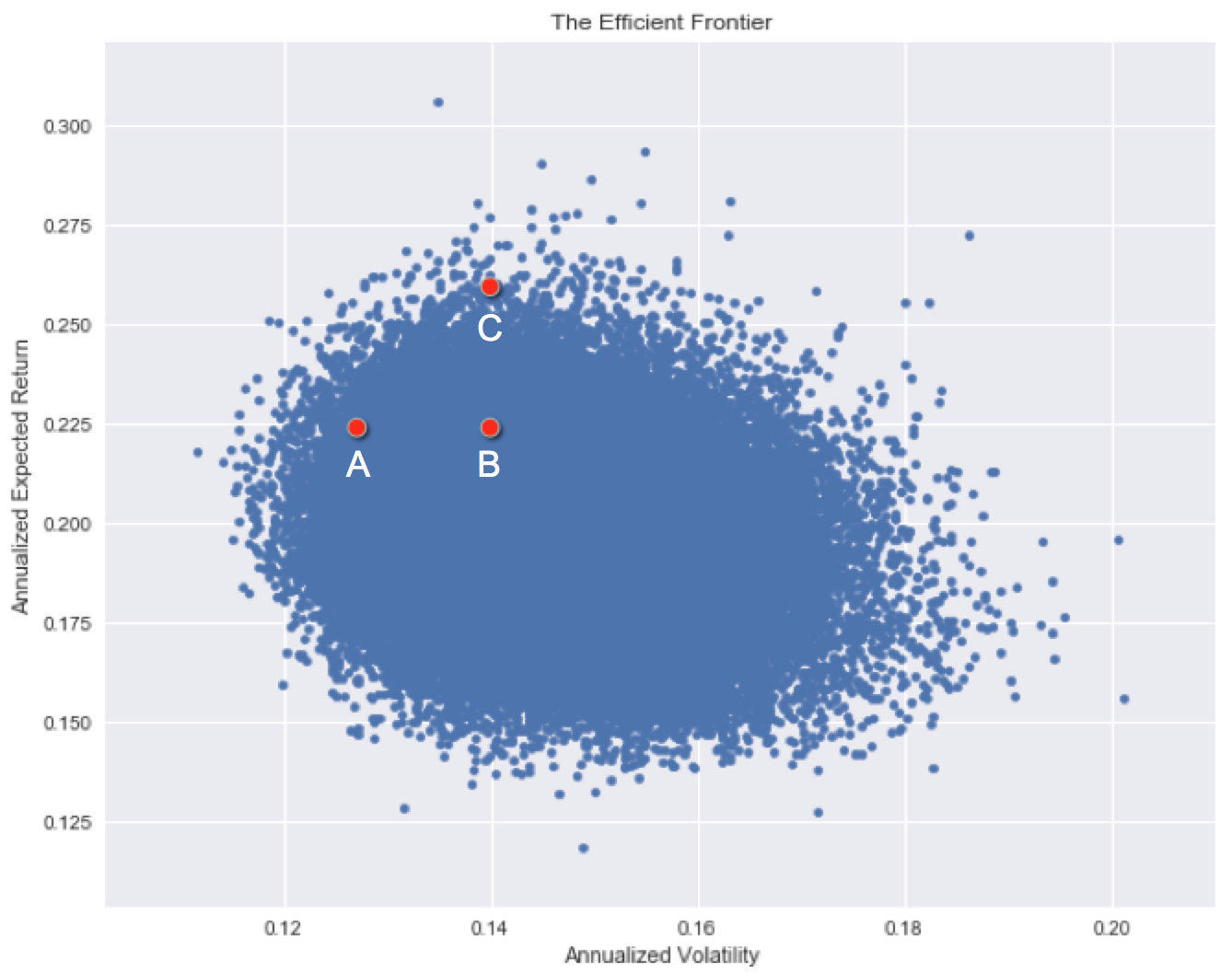

The efficient frontier

One of the ways to construct the efficient frontier of risk vs return given a set of assets is to randomly generate combinations and plot the characteristics of each portfolio. In this plot, the x-axis is the risk (standard deviation) and the y-axis is the expected return of each portfolio.

Each investment has a historical risk level and a historical return. Note how some assets are more superior than others historically, but some are hard to choose between.

Which investment has the best historical risk / return characteristics?

Questo esercizio fa parte del corso

Introduction to Portfolio Risk Management in Python

Esercizio pratico interattivo

Passa dalla teoria alla pratica con uno dei nostri esercizi interattivi

Inizia esercizio

Inizia esercizio