The recursive nature of the GARCH variance

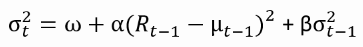

Under the GARCH(1,1) equation the predicted variance is determined by the squared surprise in return and the previous variance prediction:

You can implement this using a loop (refer to the slides if you don't remember the loop structure from the video).

Let's do this for the S&P 500 daily returns. The variables omega, alpha, beta, nobs, e2 and predvar are already loaded in your R environment.

Diese Übung ist Teil des Kurses

GARCH Models in R

Anleitung zur Übung

- Compute the predicted variances.

- Use

predvarto define the series of predicted annualized volatilityann_predvol. - Plot the predicted annualized volatility for the years 2008-2009 to see the dynamics around the financial crisis.

Interaktive Übung

Vervollständige den Beispielcode, um diese Übung erfolgreich abzuschließen.

# Compute the predicted variances

predvar[1] <- var(sp500ret)

for(t in 2:nobs){

predvar[t] <- ___ + ___ * e2[t-1] + ___ * predvar[___]

}

# Create annualized predicted volatility

ann_predvol <- xts(___(252) * sqrt(___), order.by = time(sp500ret))

# Plot the annual predicted volatility in 2008 and 2009

___(___["2008::2009"], main = "Ann. S&P 500 vol in 2008-2009")