La naturaleza recursiva de la varianza GARCH

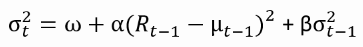

Bajo la ecuación GARCH(1,1), la varianza prevista viene determinada por la sorpresa al cuadrado en el rendimiento y la predicción de varianza anterior:

Puedes implementarlo usando un bucle (consulta las diapositivas si no recuerdas la estructura del bucle del vídeo).

Hagámoslo para los rendimientos diarios del S&P 500. Las variables omega, alpha, beta, nobs, e2 y predvar ya están cargadas en tu entorno de R.

Este ejercicio forma parte del curso

Modelos GARCH en R

Instrucciones del ejercicio

- Calcula las varianzas previstas.

- Usa

predvarpara definir la serie de volatilidad anualizada previstaann_predvol. - Representa la volatilidad anualizada prevista para los años 2008-2009 para ver la dinámica alrededor de la crisis financiera.

Ejercicio interactivo práctico

Prueba este ejercicio y completa el código de muestra.

# Compute the predicted variances

predvar[1] <- var(sp500ret)

for(t in 2:nobs){

predvar[t] <- ___ + ___ * e2[t-1] + ___ * predvar[___]

}

# Create annualized predicted volatility

ann_predvol <- xts(___(252) * sqrt(___), order.by = time(sp500ret))

# Plot the annual predicted volatility in 2008 and 2009

___(___["2008::2009"], main = "Ann. S&P 500 vol in 2008-2009")