Effektstärke für Mittelwerte

Viele von Venture Capital finanzierte Unternehmen erhalten mehr als eine Finanzierungsrunde. Allgemein ist die zweite Runde größer als die erste. Wie stark beeinflusst die Rundennummer den durchschnittlichen Finanzierungsbetrag? Mit Cohen's d kannst du das quantifizieren.

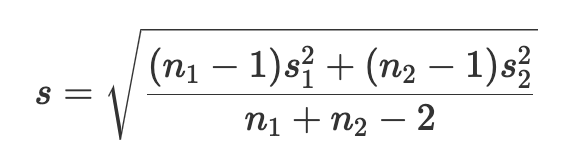

Zur Erinnerung: Um Cohen's d zu berechnen, musst du zuerst die gepoolte Standardabweichung berechnen. Diese ist gegeben durch die Gleichung

Cohen's d ergibt sich dann als:

Ein DataFrame mit Venture-Capital-Investitionen (investments_df) wurde für dich geladen, ebenso die Pakete pandas als pd, NumPy als np und stats aus SciPy. Die Spalte funding_total_usd zeigt die gesamte Finanzierung, die in dieser Runde erhalten wurde.

Diese Übung ist Teil des Kurses

Grundlagen der Inferenz in Python

Anleitung zur Übung

- Filtere

investments_df, umfunding_rounds1 und 2 jeweils separat auszuwählen. - Berechne die Standardabweichung und die Stichprobengröße jeder Runde.

- Berechne die gepoolte Standardabweichung zwischen den beiden Runden.

- Berechne Cohen's d mit den soeben ermittelten Größen.

Interaktive Übung

Vervollständige den Beispielcode, um diese Übung erfolgreich abzuschließen.

# Select all investments from rounds 1 and 2 separately

round1_df = investments_df[____['funding_rounds'] == ____]

round2_df = investments_df[____['funding_rounds'] == ____]

# Calculate the standard deviation of each round and the number of companies in each round

round1_sd = ____.std()

round2_sd = ____.std()

round1_n = ____.shape[0]

round2_n = ____.shape[0]

# Calculate the pooled standard deviation between the two rounds

pooled_sd = np.sqrt(((____ - 1) * ____ ** 2 + (____ - 1) *____ ** 2) / (____ + ____ - 2))

# Calculate Cohen's d

d = (____.mean() - ____.mean()) / ____