Deferred life insurance

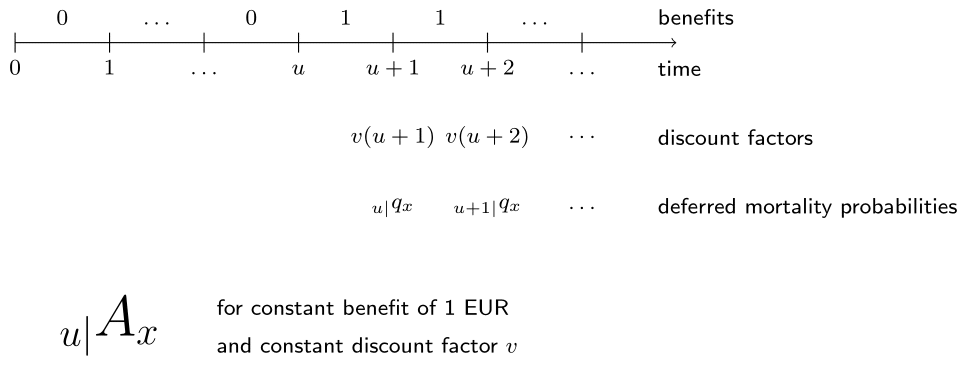

Cynthia now challenges Ethan to change the code himself to calculate the EPV of a deferred life insurance on \((x)\) for a given constant interest rate \(i\). The following figure shows the corresponding timeline for a deferral period of \(u\) years.

There is no death benefit if the policyholder dies during the first \(u\) years. From time \(u\) on, a death benefit of 1 EUR is payable at the end of the year of death of the policyholder.

The function whole_life_insurance() and the EPV of a whole life insurance for a 20-year-old at interest rate \(i = 2\%\) and using the 1999 female life_table are given as a starting point.

This exercise is part of the course

Life Insurance Products Valuation in R

Exercise instructions

- Specify the

deferred_life_insurance()function which computes the EPV of a deferred life insurance for a givenage, deferral periodu, interest rateiandlife table. - Apply the

deferred_life_insurance()function to compute the EPV of a life insurance with a deferral period of 45 years. Use age 20, interest rate 2% and the preloaded 1999 femalelife_table.

Hands-on interactive exercise

Have a go at this exercise by completing this sample code.

# EPV of a whole life insurance for (20) at interest rate 2% using life_table

whole_life_insurance(20, 0.02, life_table)

# Function to compute the EPV of a deferred whole life insurance

deferred_life_insurance <- function(age, u, i, life_table) {

qx <- life_table$qx; px <- 1 - qx

kpx <- c(1, cumprod(px[(age + 1):(length(px) - 1)]))

kqx <- kpx * qx[(age + 1):length(qx)]

discount_factors <- (1 + i) ^ - (1:length(kqx))

benefits <- c(rep(___, ___), rep(___, length(kpx) - u))

sum(___ * discount_factors * kqx)

}

# EPV of a deferred life insurance for (20) deferred over 45 years at interest rate 2% using life_table

deferred_life_insurance(___, ___, ___, ___)