Take it easy: a simple life insurance

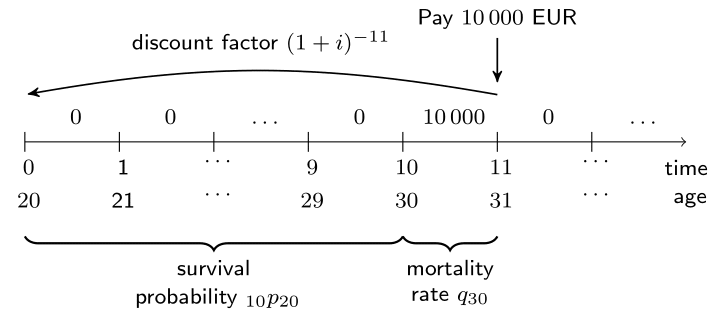

Cynthia wants to help her friend Ethan who is studying for the Long-Term Actuarial Mathematics exam organized by the Society of Actuaries. She explains him a very simple life insurance product: a product sold to \((20)\) that pays 10,000 EUR at the end of the year of death if death occurs at a given age \(30\). The figure illustrates how you should value this life insurance coverage.

You can assume an interest rate \(i = 1\%\) and use the one-year survival probabilities px and mortality rates qx which have been preloaded.

This exercise is part of the course

Life Insurance Products Valuation in R

Exercise instructions

- Define

kpxas the 10-year survival probability of (20). - Assign the 10-year deferred mortality probability of (20) to

kqx. - Specify the discount factor that discounts a payment at the end of year 11 to the present moment at rate 1%.

- Calculate the EPV of the simple life insurance product by multiplying the benefit of 10,000 EUR with

discount_factorandkqx.

Hands-on interactive exercise

Have a go at this exercise by completing this sample code.

# 10-year survival probability of (20)

kpx <- ___(___[(___):(___)])

kpx

# 10-year deferred mortality probability of (20)

kqx <- ___ * ___[___]

kqx

# Discount factor

discount_factor <- (1 + ___) ^ - ___

discount_factor

# EPV of the simple life insurance

___ * ___ * ___