Effect size for means

Many venture capital-backed companies receive more than one round of funding. In general, the second round is bigger than the first. Just how much of an effect does the round number have on the average funding amount? You can use Cohen's d to quantify this.

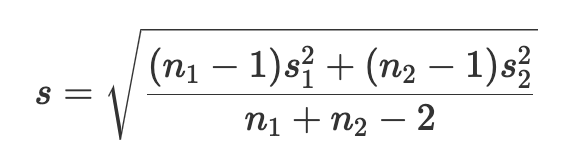

Recall that, to calculate Cohen's d, you need to first calculate the pooled standard deviation. That is given by the equation

Cohen's d is then given by:

A DataFrame of venture capital investments (investments_df) has been loaded for you, as have the packages pandas as pd, NumPy as np and stats from SciPy. The column funding_total_usd shows the total funding received in that round.

This exercise is part of the course

Foundations of Inference in Python

Exercise instructions

- Filter

investments_dfto selectfunding_rounds1 and 2 separately. - Calculate the standard deviation and sample size of each round.

- Calculate the pooled standard deviation between the two rounds.

- Calculate Cohen's d using the terms you just calculated.

Hands-on interactive exercise

Have a go at this exercise by completing this sample code.

# Select all investments from rounds 1 and 2 separately

round1_df = investments_df[____['funding_rounds'] == ____]

round2_df = investments_df[____['funding_rounds'] == ____]

# Calculate the standard deviation of each round and the number of companies in each round

round1_sd = ____.std()

round2_sd = ____.std()

round1_n = ____.shape[0]

round2_n = ____.shape[0]

# Calculate the pooled standard deviation between the two rounds

pooled_sd = np.sqrt(((____ - 1) * ____ ** 2 + (____ - 1) *____ ** 2) / (____ + ____ - 2))

# Calculate Cohen's d

d = (____.mean() - ____.mean()) / ____