Temporary vs lifelong

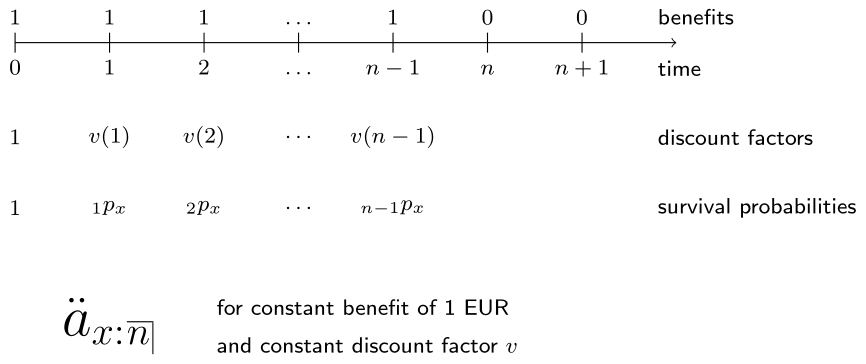

Finally, can you assist Cynthia in writing a function for a temporary life annuity due in which the payments are restricted in time? The first payment takes place at time \(0\) and the last at time \(n-1\).

Both life_table and the R function life_annuity_due are still available in your workspace.

This exercise is part of the course

Life Insurance Products Valuation in R

Exercise instructions

- Define the function

temporary_life_annuity_due()starting from thelife_annuity_due()code such that the EPV is computed for a temporary life annuity due. The function now has an extra argumentnwhich indicates the number of payments. Bothkpxanddiscount_factorsshould hence have a total length ofn. - Use

temporary_life_annuity_due()to calculate the EPV of a 10-year life annuity due for (20) at rate 2% using the 1999 period life table for females.

Hands-on interactive exercise

Have a go at this exercise by completing this sample code.

# EPV of a whole life annuity due for (20) at interest rate 2% using life_table

life_annuity_due(20, 0.02, life_table)

# Function to compute the EPV of a temporary life annuity due for a given age, period of n years, interest rate i and life table

temporary_life_annuity_due <- function(age, n, i, life_table) {

px <- 1 - life_table$qx

kpx <- c(1, cumprod(px[(___):(___)]))

discount_factors <- (1 + i) ^ - (0:(___))

___

}

# EPV of a temporary life annuity due for (20) over 10 years at interest rate 2% using life_table

temporary_life_annuity_due(___, ___, ___, ___)