A function to price a life annuity

Cynthia's internship supervisor does not have much experience with R. He asks her to write an R function that calculates the EPV of a (whole) life annuity due on \((x)\) for a given constant interest rate \(i\) and life table.

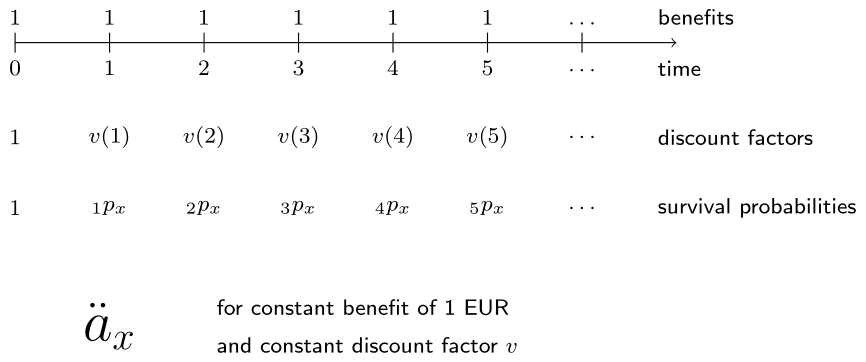

Since the benefit is constant at 1 EUR, there is no need to take it explicitly into account in the calculations.

This exercise is part of the course

Life Insurance Products Valuation in R

Exercise instructions

- Write a function

life_annuity_due()that calculates the EPV of a whole life annuity due for input argumentsage, interest rateiandlife_table. - Apply

life_annuity_due()to compute the EPV of a life annuity due for (20) at rate 2%. Use the 1999 Belgian period life table for females which is preloaded aslife_table. - Find out how the EPV changes if the interest rate increases to 5% (keeping the age at 20). And what if the age changes to 65 (keeping the interest rate at 2%)?

Hands-on interactive exercise

Have a go at this exercise by completing this sample code.

# Function to compute the EPV of a whole life annuity due for a given age, interest rate i and life table

life_annuity_due <- function(age, i, life_table) {

px <- ___

kpx <- c(___, ___(px[(___):length(px)]))

discount_factors <- (___) ^ - (0:(___))

sum(discount_factors * kpx)

}

# EPV of a whole life annuity due for (20) at interest rate 2% using life_table

life_annuity_due(___, ___, ___)

# EPV of a whole life annuity due for (20) at interest rate 5% and for (65) at interest rate 2% using life_table

life_annuity_due(___, ___, ___)

life_annuity_due(___, ___, ___)