From single to annual premium

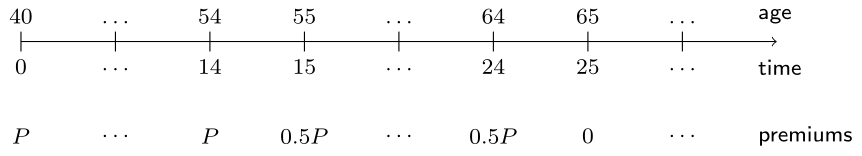

Miss Cathleen wants to finance her deferred life annuity with annual premiums payable for 25 years beginning at age 40. But since she plans to reduce her teaching hours from age 55 on, the premium should reduce by one-half after 15 years, as shown in the graph below. What will be the initial premium to be paid by Miss Cathleen?

The variables kpx, discount_factors and single_premium computed in the previous exercise are preloaded.

This exercise is part of the course

Life Insurance Products Valuation in R

Exercise instructions

- Define the premium pattern as

rho. This vector should have the same length askpx. - Compute and print the

initial_premiumby dividingsingle_premiumby the sum of the elementwise multiplication ofrho,discount_factorsandkpx. - Inspect the annual premiums by printing the product of

initial_premiumandrho. - Without taking the time value of money and the mortality into account, compute the total sum that Miss Cathleen has to pay to finance the life annuity.

Hands-on interactive exercise

Have a go at this exercise by completing this sample code.

# Premium pattern rho

rho <- c(rep(1, ___), rep(0.5, ___), rep(0, ___))

# The initial premium

initial_premium <- ___ / ___(___ * ___ * ___)

initial_premium

# The annual premiums

___ * ___

# Sum of the annual premiums (no actuarial discounting)

___(___ * ___)