A retirement plan for Miss Cathleen

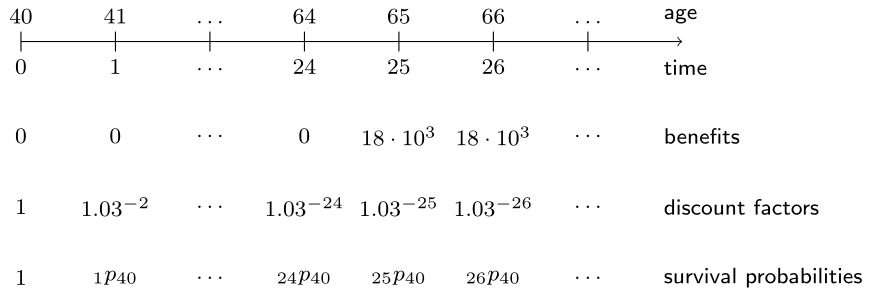

As a final assignment during her summer internship Cynthia is asked to do some calculations for Miss Cathleen. Miss Cathleen is a teacher, aged 40, who is planning for retirement. She wants to buy an annuity that provides her 18,000 EUR annually for life, beginning at age 65. Nothing is paid in case of death before 65. The figure below depicts the retirement plan for Miss Cathleen.

The one-year survival probabilities px are again preloaded.

This exercise is part of the course

Life Insurance Products Valuation in R

Exercise instructions

- Define

kpxfor a 40-year-old female. - Create

discount_factorswhich discount payments at time zero (age 40) up to timelength(kpx) - 1at rate 3%. - Assign the pension payments to

benefits. Make sure this vector has the same length askpx. - Compute the

single_premiumas the sum of elementwise product ofbenefits,discount_factorsandkpx. Print out the result.

Hands-on interactive exercise

Have a go at this exercise by completing this sample code.

# Survival probabilities of (40)

kpx <- c(___, ___(px[(___):___]))

# Discount factors (to age 40)

discount_factors <- (1 + ___) ^ -(0:(___))

# Pension benefits

benefits <- c(rep(___, ___), rep(___, length(kpx) - 25))

# The single premium

single_premium <- ___

single_premium