Net present value of investments

Joe, the owner of Cynthia's favorite restaurant, asks for some advice. He wants to buy a new pizza oven, worth 10,000 EUR. He expects that this investment will generate additional cash flows but he wonders whether the new oven is a profitable investment.

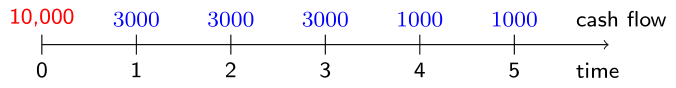

You should calculate the net present value (NPV) of Joe's investment. This NPV is the sum of the present values of the future cash flows (in blue) generated by the investment, minus its initial cost of 10,000 (in red) at time 0.

What is your advice for Joe? Assume that interest rates are constant and equal to 5%.

This exercise is part of the course

Life Insurance Products Valuation in R

Exercise instructions

- Create

cash_flowswith the positive cash flows related to the investment. The vector starts with a zero. - Define

discount_factorsas 1 plus the interest rate of 5% to minus a vector from 0 to 5. - Compute the

net_present_valueof the investment as the present value of the future profits minus the initial cost of 10,000. Will Joe realize an overall profit or loss?

Hands-on interactive exercise

Have a go at this exercise by completing this sample code.

# Define the cash flows

cash_flows <- c(0, ___(___, ___), ___(___, ___))

# Define the discount factors

discount_factors <- (1 + ___) ^ - (___)

# Calculate the net present value

net_present_value <- ___(___ * ___) - ___

net_present_value