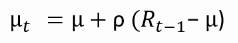

The AR(1)-GJR GARCH dynamics of MSFT returns

You have seen in the video that the sign of the autoregressive parameter in the AR(1) model depends on the market reaction to news

A positive value of \(\rho \) is consistent with the interpretation that markets under-react to news leading to a momentum in returns. A negative value of \(\rho \) is consistent with the interpretation that markets over-react to news leading to a reversion in returns.

Are the daily Microsoft returns characterized by a momentum or a reversal effect in their AR(1) dynamics? Let's find this out by estimating the parameters of the AR(1)-GJR GARCH model using the daily Microsoft returns in msftret.

This exercise is part of the course

GARCH Models in R

Exercise instructions

armaOrder = c(1,2)corresponds to an ARMA(1,2) model. An AR(1) model is the same as ARMA(1,0).- Complete the

mean.modelargument inugarchspecto specify the AR(1) model to be used. - Estimate the model.

- Print the first two coefficients of the estimated GARCH model.

Hands-on interactive exercise

Have a go at this exercise by completing this sample code.

# Specify AR(1)-GJR GARCH model

garchspec <- ugarchspec(mean.model = list(armaOrder = ___ ),

variance.model = list(model = "gjrGARCH"),

distribution.model = "sstd")

# Estimate the model

garchfit <- ___

# Print the first two coefficients

___(___)[c(1:2)]